'Shark Tank' Season 14: Lori Greiner retracts offer as Tony Xu, Barbara Corcoran jointly invest in Kinfield

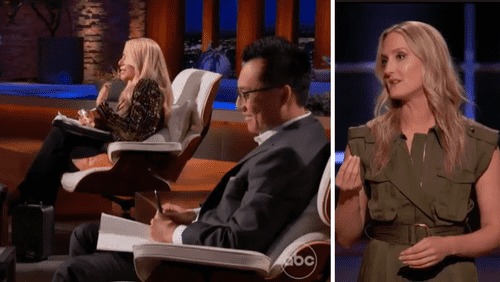

LOS ANGELES, CALIFORNIA: If you enjoy being outside, you should be familiar with bug repellant, sunscreen, and anti-itch balms. They do, however, frequently contain substances that are detrimental to both the person and the environment. Nichole Powell was given the opportunity to pitch her company on 'Shark Tank', and she ended up signing a contract with Sharks Barbara Corcoran and Tony Xu. Shark Lori Greiner, who had previously offered her a deal, opted to withdraw her offer when the blossoming founder expressed interest in other Sharks.

On Season 14 of 'Shark Tank,' San Francisco entrepreneur Nichole Powell pitches Kinfield, her eco-friendly, "outdoor" skincare beauty firm. The firm provides "clean bug spray that works and sunscreen you’ll actually love."

RELATED ARTICLES

'Shark Tank' fans slam David Schwimmer for failing to support his friend's business

Nichole stepped into the Tank looking for $250k in exchange for 5% of her firm. Nichole grew up enjoying outdoor activities. Regardless, she realized that standard skincare products haven't altered in years. Her insect repellant included a chemical component known as DEET, which no one wanted to use due to its bad environmental impacts. She traversed the world in search of an insect repellant that does not include DEET. Kinfield began in 2018 after creating her first product, and they secured a seed round of $2.1 million from six investors. Her DEET-free repellant was a huge success, selling out three times.

Shark Kevin O'Leary expressed concern about Nichole's valuation of the company, which was $5 million, and demanded to know how the sales figures looked. Nichole informed him that she launched her product line in the summer of 2019, making $45k in sales, $187k in 2020, and $565k in 2021, all through online sales. However, she stated that she has not made any money throughout this time period. By the time this pitch was filmed in 2022, the firm had made $1.5 million in revenue and was on target to make $2.1 million. She said that she won't be generating money right away, but that she expects to be profitable in about a year and a half.

Kinfield's client acquisition cost is around $26. Most of the company's goods have margins ranging from 79 to 85 percent. Kinfield Golden Hour DEET-Free Repellent costs $4.53 to make and retails for $22. Cloud Cover SPF 35 costs $5.04 and retails for $34. Kinfield's website has an average order value of $45. Although around 80% of clients purchase directly from the internet, Nichole feels that being in both online and retail is critical to creating a thriving business. When Tony wonders if she truly has to shoot for retail, Nichole responds that her items belong within the convenience category. Retail must be a part of their journey because of the immediate need. However, Shark Mark Cuban believes she will lose money in retail due to distribution costs, marketing support costs, and more advertising. He believes Nichole will need to gather additional funds for R&D, inventory, scalability, and promotion, and he worries he will be duped into getting nothing. Nichole reminds him that, in addition to acquiring funds through investor capital, there is also a line of credit. She is now in debt for less than $500,000. Mark declines a deal because he does not see a future in the business.

Barbara makes her an offer of $250k for 10% and a $2 royalty on each unit sold until the $250k is paid. Kevin offers $250k in exchange for a 5% share and a $1.50 royalty on each unit sold until $759k is paid. Lori's past with Bug Bite Thing recalls Nichole that they generated $25 million in sales across 3000 locations in a couple of years, so she offers Nichole $250k for a 5% ownership and a $4 royalty for every item sold until the $250k is paid. Tony adds a $250k for 10% offer to the mix since he doesn't want to take money away from the business and hence sticks to equity. Tony's offer was matched by Barbara. The difficult issue with royalties right now, according to Nichole, is that they will have to accept a lower margin when they go into retail. She inquires whether Tony and Barbara will join in the deal in which they each contribute $125,000 for a 10% interest. Lori was ready to withdraw her prior offer after hearing Nichole's proposal to Barbara and Tony. Nichole chose Barbara and Tony's deal because their offer of equity made her believe they were in it for the long haul.

'Shark Tank' Season 14 airs every Friday at 8/7c on ABC.

Missed an episode? Been wanting to catch up? Episodes can also be viewed the next day on demand and on Hulu. Not just that, you can also watch old seasons and episodes on Amazon Prime Video and iTunes.