'The Blech Effect': Who is David Blech, 'King of Biotech' and former millionaire investor with the Midas touch?

In the 1980s, David Blech was a well-known name associated with the nascent biotech industry. He was the top gunslinger whose hustle and investment helped pioneer the model of financing emerging medical solutions. Once an eminent inclusion in the Forbes 400 list of wealthiest Americans and worth $300 million, Blech's flair helped coin the industry term 'The Blech Effect', referring to the way investment capital, technology, and medical science combined to yield incredible results. His successes were short-lived however, as soon, everything began to unravel around him.

Blech's story is the subject of a new unscripted film by David Greenwald, a seasoned editor who is making his debut as a documentary director. As per the film's synopsis, in 2012, Blech pleaded guilty to securities fraud. Now he is $11 million in debt and has a possible prison sentence awaiting him, while he tries to keep his family afloat. Growing up a yeshiva boy in Brooklyn, New York, Blech has a Master's degree in Music Education from the Teacher's College of Columbia University. After a mildly successful career in music, Blech and his brother, Isaac, ventured into business with their rabbi father, starting if as small-time investors in unknown biotech firms. blech had no training in science but he needed the money to support his ambition of songwriting. Blech, then 24, and his brother, each started their own companies as well as joint ventures from scratch and built upon it, making it worth millions in return on their investments.

Blech's first venture investment was a firm called Genetic Systems, which was built focusing on promising scientists, including the renowned microbiologist Robert Nowinski. It invested in technology being used across the medical sector and developed the first affordable and accurate test to diagnose sexually-transmitted diseases using monoclonal antibodies. This allowed thousands of babies to be born to women, who would have otherwise become sterile from pelvic inflammatory disease. The company was acquired by Bristol-Myers Squibb in 1986 in exchange for $294 million out of its stock.

Blech went on to be labeled as the 'King of Biotech' for his influence on the biotech industry, investing in start-ups and helping foster the faltering ones. In 1989, Blech cofounded Icos Corporation with Nowinski and George B Rathmann, that received $33 million in start-up funding, the largest in biotech history. Icos developed the impotence pill Cialis, which was acquired by Eli Lilly in 2003 for $2.6 billion. The Blech brothers also cofounded industry giant Celgene Corporation, which developed two major cancer drugs, in 1986. The company is currently valued at over $35 billion, making it the fifth-largest biotech company in the world.

Blech also helped establish companies like DNA Plant Technology, Neurogen Corporation, Incyte Pharmaceuticals, rare disease specialist Alexion Pharmaceuticals, cancer drug developer ARIAD Pharmaceuticals, Neurocrine Biosciences, Cytosorbents Inc, and Intellect Neurosciences. In addition, he was instrumental in the Turnaround of Liposome Technology Inc and Biotech General Corporation. Today, the companies that he helped create comprise a value of $144 billion. His stake in Alexion would be worth $1 billion.

The trouble started in 1990, when Blech's ambitiousness incited his desire for expansion, while his cautious brother proposed a hiatus. As a result, the conflicting interests caused a rift between the brothers who haven't talked to each other since. That year, Blech established D Bech & Company, a registered broker-dealer involved in underwriting biotechnology stock offerings. When creditors began calling in the loans, Blech, in a move out of desperate motives started engaging in fraudulent trades to make it look like all was well. His entire enterprise collapsed on September 22, 1994, falling deep into debt and in violation of net capital rules and comeback attempts were futile. This day came to be known as 'Blech Thursday' in the biotech industry.

Things only got worse from then on. His failure had severe emotional repercussions on Blech to the point that he had to check himself into a hospital psychiatric ward. He, later on, said he has bipolar disorder, battling manic depression and gambling addiction for which he has started seeking help. The daily regimen of shrinks and drugs however took a toll on his decision-making. His wife filed for divorce, while the rest of the holdings, including the stake in Alexion, were sold off for about $40 million to pay creditors. Blech eventually came under investigation by the US Securities and Exchange Commission for securities fraud. He pleaded guilty to two counts of criminal fraud and was sentenced to five years of probation because of his bipolar disorder and his cooperation with the government.

By the time he was out of his probation period, his old formula was no longer applicable. The $15 million he had sheltered in trusts for his children were no longer that far. Moreover, start-ups could no longer go public simply because they had 'genetic' in their names, and more importantly, no company wanted a felon as a financer. So Blech found another alternative, turning to hard-pressed penny stock companies and he practically reverted to his past behavior by trading through more than 50 nominee accounts in the name of his new wife and other relatives.

According to prosecutors and a New York Times report, he used some nominee accounts to sell his shares, while using the others to buy shares, eventually reducing his holdings to make it appear like there was an active market for the stock. This scheme allowed him to sell the shares for $1.2 million, when otherwise he may have got have nothing, said, prosecutors. In 2012, Blech pleaded to two counts of securities fraud and again asked for leniency in the penalty, citing his bipolar disorder. medical contributions and the difficulties a prison sentence would impose on his family, especially his autistic son Evan.

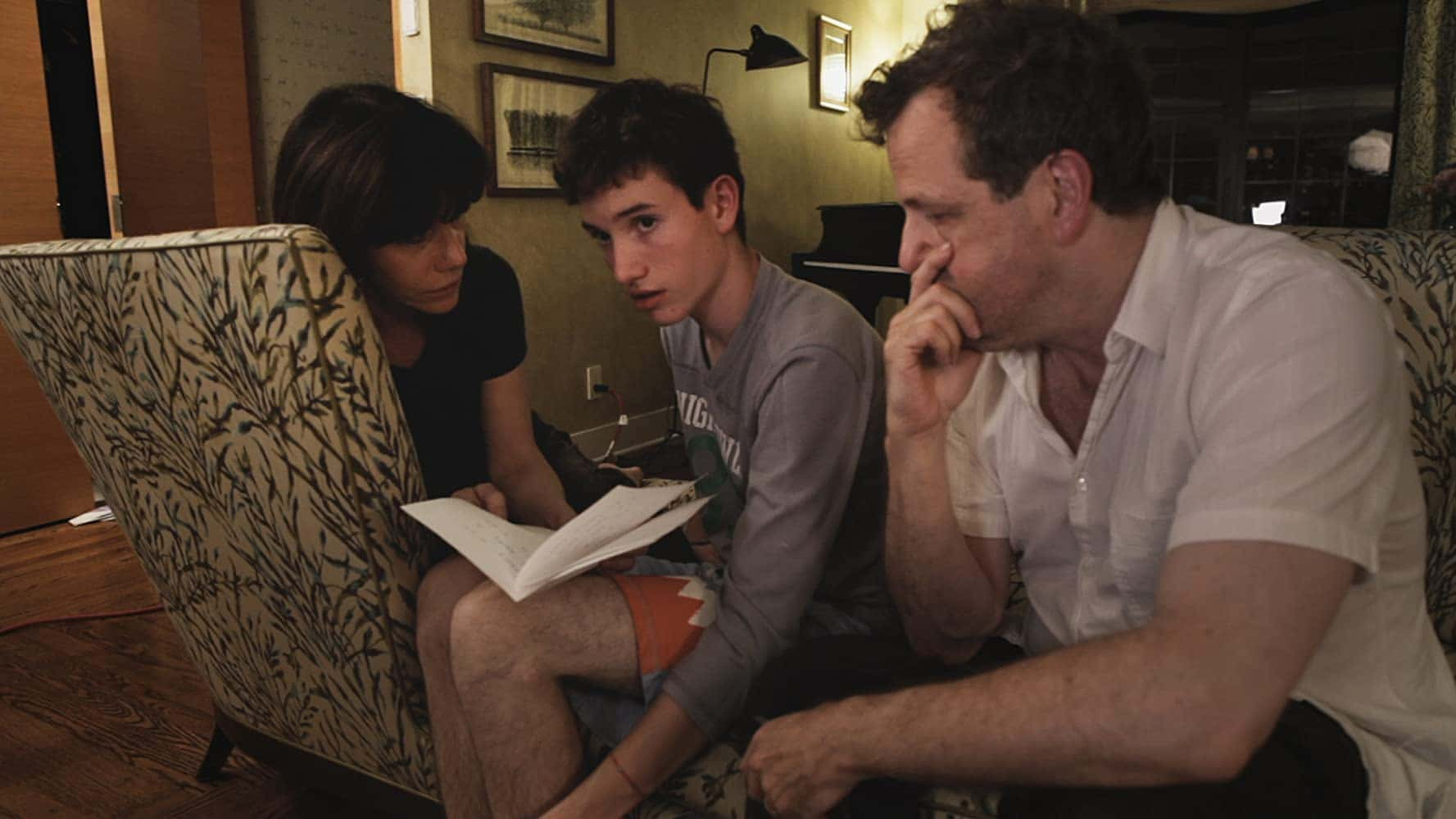

The film shows Blech facing the possibility of imprisonment. His family's last hope is his only remaining asset, a stake in a company developing a drug to treat Alzheimer's disease, called Intellect Neuroscience. 'The Blech Effect' which will be available on VoD on August 25, is a documentary worth watching for the impactful and intimate first-hand account it gives of a man that was once the American biotech industry's driving force. It chronicles the journey of Blech, who in his most vulnerable state and plagued by his mental issues confronts his reality, and strives to fight the hellish situation for the sake of his family.