Why didn’t Jeff Bezos, Elon Musk or Bill Gates' names appear in Pandora Papers leak?

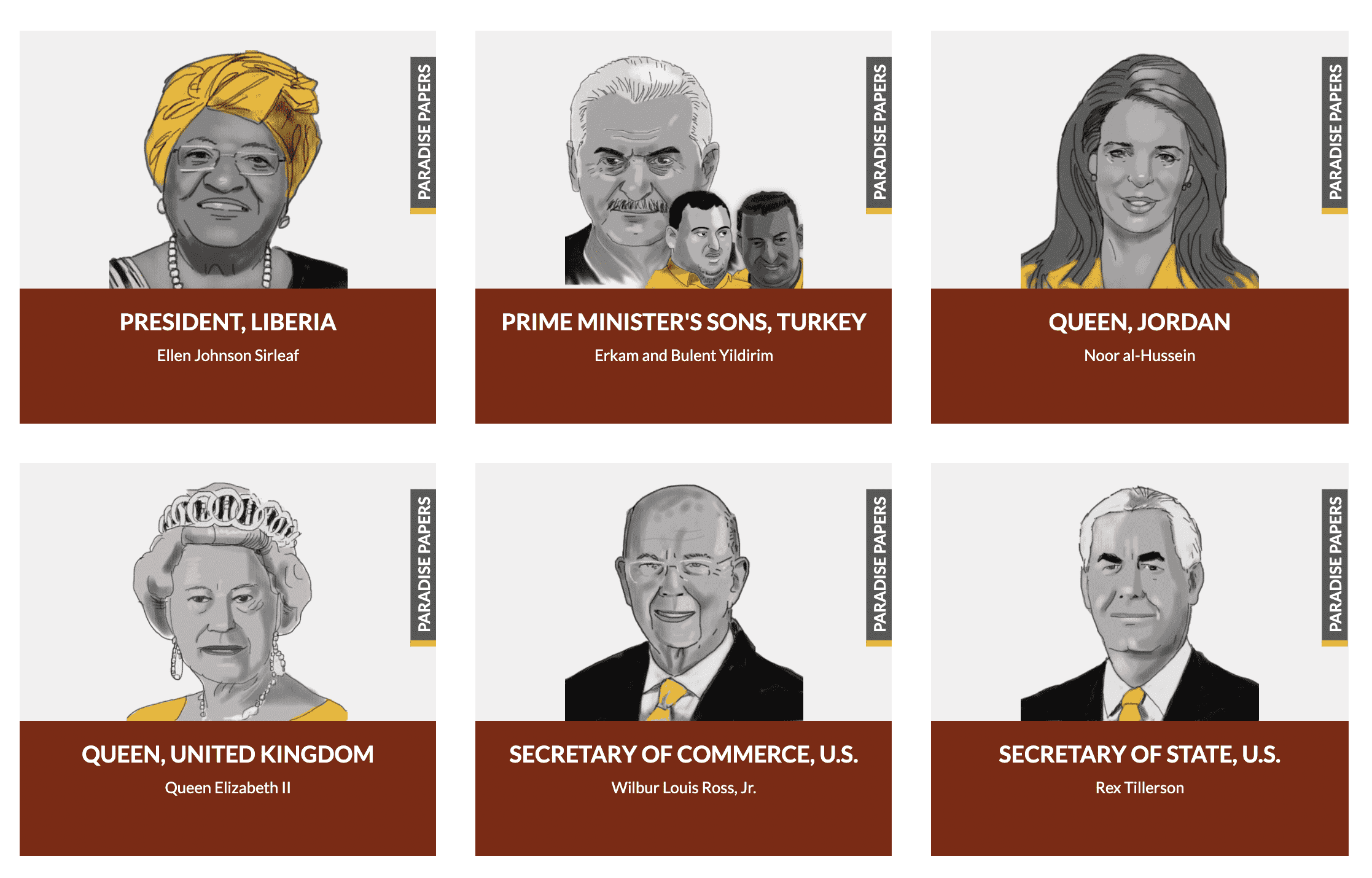

Over 300 politicians, celebrities, and billionaires have been named in the massive Pandora Papers leak published on October 3. From Secretary of State Rex Tillerson to former Canadian PM Paul Martin and even Queen Elizabeth, a large number of the world's most wealthy and powerful have been publicly named in the explosive report. However, if you look very closely, you'll notice some key names missing.

From Jeff Bezos to Elon Musk, and Bill Gates to Warren Buffet, the names that dominate Forbes' list of richest people are conspicuously absent from the Pandora Papers. In fact, out of the world's 20 wealthiest people, no one is mentioned in the Pandora Papers. Most of those linked to the data leak are politicians or those related to politicians such as Vladamir Putin's close friend Sergey Roldugin.

RELATED ARTICLES

Who leaked IRS files? ProPublica publishes ‘tax secrets’ of Elon Musk, Jeff Bezos and Bill Gates

Biden’s tax hypocrisy: POTUS slammed over loophole that let him skirt $500k in taxes

That's not to say some of the wealthiest people aren't named. From pop idol Shakira to Indian cricket icon Sachin Tendulkar, there are quite a few millionaires linked to the data leak. But the list is missing some of the world's richest people. It isn't an accident though but by design. Experts have a key theory for why names like Buffet, Bezos, and Gates aren't on the list, and it has to do with the global tax system.

Pandora Papers expose tax havens

Before we explore why those names aren't on the list, here's a quick understanding of what the Pandora Papers reveal. The massive data dump, a cache of 11.9m files, exposes the complex and consulted financial web of tax havens, banks, and offshore companies and trusts that rich people use. Through this intricate web, the ultrawealthy can avoid paying taxes while buying yachts, mansions, insurance, and even artwork.

To be clear, having an offshore company isn't entirely illegal, but the papers show how the system is being used by some rather questionable people, including some who have been "accused of serious financial crimes." It also puts the spotlight on how some politicians are benefitting at a time when global economies are struggling to recover from the pandemic, with a bulk of the recovery borne by ordinary taxpayers.

To sum it up, the papers show how politicians are using international offshore havens to avoid paying tax, even though they need to. Most accounts linked to the Pandora Papers have been designed to conceal assets and evade taxes on those assets, vital for politicians who are constantly vying for public sympathy and attention. But when you are as rich as Musk, or Buffet, that's not at all an issue.

Why the ultrawealthy aren't mentioned

According to experts, the reason the world's richest people aren't mentioned in the papers is because they pay so little tax, they simply don't need the intricate system of offshore accounts and havens. A June 2021 Forbes report noted that the 25 richest Americans paid a "true tax rate" of 3.4% on wealth growth of $401billion between 2014 and 2018. That's compared to the 14% the median American household pays in federal taxes.

Because of that low rate of tax, experts told The Washington Post the uber-rich have "less incentive to seek offshore havens" as compared to those mentioned in the papers. Another reason is that they could be using different offshore havens, like the Cayman Islands, that aren't mentioned in the Pandora Papers. It is also possible they could be using other entities and trusts to hide their money, which is yet to surface.

Ultimately though, exposes like the Pandora Papers indicate how politicians and those connected to them are able to benefit from the complex global financial system. Unlike those topping Forbes' charts, they have a greater incentive to hide their wealth because of the nature of their work. It also highlights the economic disparities and raises questions about the characters of those running for office. "These systems don't just allow tax cheats to avoid paying their fair share. They undermine the fabric of a good society," former FBI officer Sherine Ebadi told The Post.