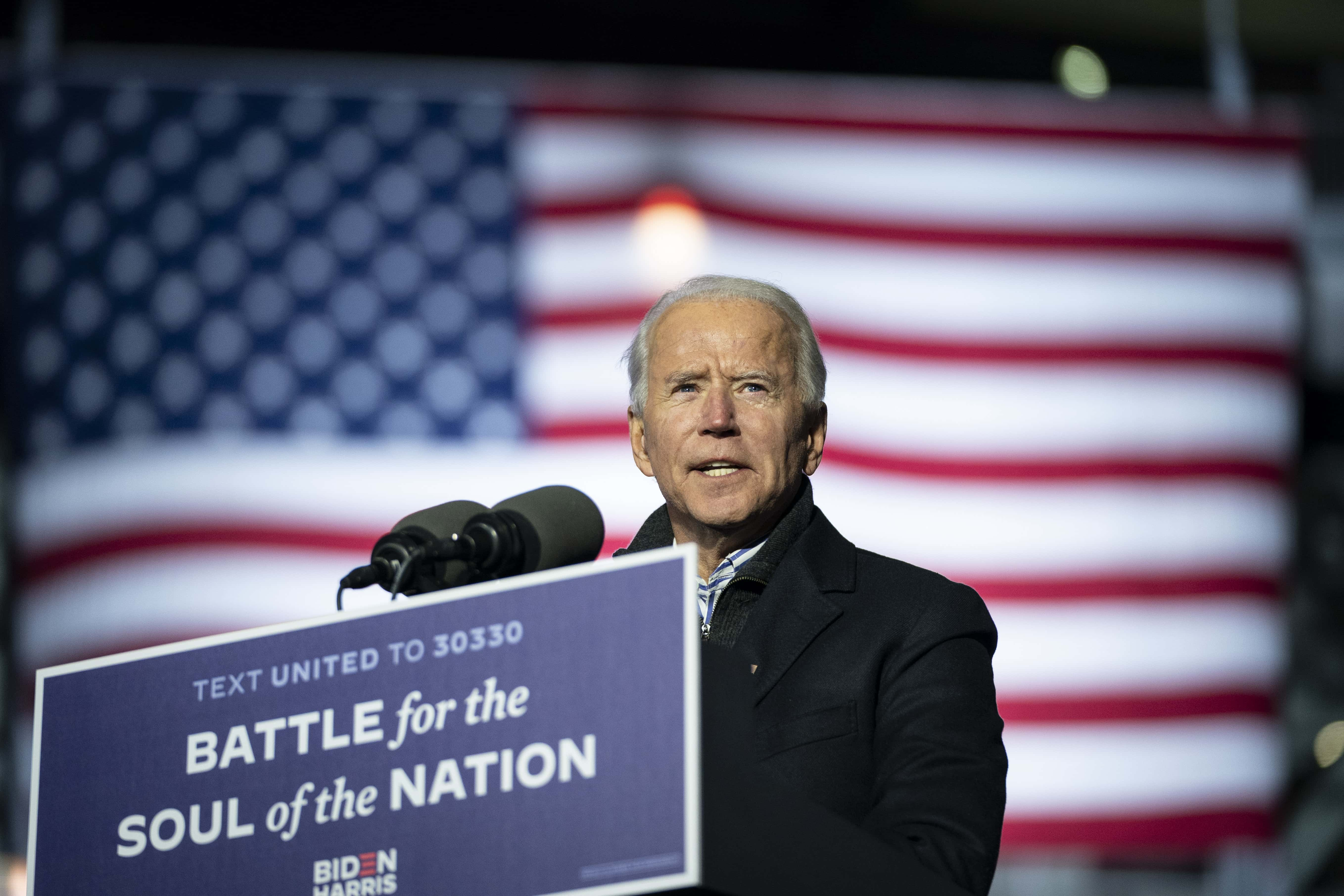

Has Joe Biden forgotten his promise to cancel student loan debt? Here's why he has failed to act so far

In 2020, the US surpassed owing over $1.7 trillion in student debt, according to the Federal Reserve. In the past decade alone, student debts have increased by 102%, making it one of America's most severe crises. Canceling debt has long been a dream for many and with President Joe Biden in the White House, it could be a reality. While on the campaign trail, Biden had promised that he would tackle the student debt crisis numerous times but over a month into his time in the White House there has been no action so far.

If anything, Biden's stance towards the issue has become even more confusing after a series of comments at his first Presidential Town Hall in Milwaukee, Wisconsin. As he continues to delay, the crisis gets worse. A survey by Student Loan Planner found: "1 in 16 had considered suicide due to student loans." Combined with the economic fallout from Covid-19, the crisis is only going from bad to worse.

Let's take a look at all the promises Biden made during his campaign trail and what he has actually worked on so far. But before that's, here's a closer look at just how grave the student debt crisis really is.

RELATED ARTICLES

Joe Biden inked 45 executive orders so far: From Covid-19 to immigration, here's the complete list

America's debt crisis in numbers

As of 2020, the average individual student loan debt is $38,792.

2019 saw a 26% increase in the amount students borrowed as compared to 2009.

44.7 million Americans have a student loan debt.

72% of student loan accounts were reported as in forbearance or deferral, which amounts to nearly $1.1 trillion.

Gen Z students had the most spike in debt since 2019 – 39% – followed by the Baby Boomers, who had a 16% spike in debt.

What were Joe Biden's promises?

While on the campaign trail, Biden promised to take action on student loans, if elected. He broadly classified his plans into two categories –

A) Immediate cancellation of $10,000 for every borrower as a form of Covid-19 relief

B) Cancellation of all undergraduate student loans for debt-holders who attended public universities and HBCUs, and who earn up to $125,000 a year

There is a clear record of the promises Biden made, along with plenty of examples in the public domain.

On his website joebiden.com, Biden states: "More than halve payments on undergraduate federal student loans so individuals will pay 5% of their discretionary income over $25,000 towards their loans. After 20 years, the remainder of the loans for people who have responsibly made payments through the program will be 100% forgiven." He also says "Individuals making $25,000 or less per year will not owe any payments on their undergraduate federal student loans and also won’t accrue any interest on those loans."

Biden also said on the site "$10,000 of undergraduate or graduate student debt relief for every year of national or community service, up to five years." It's not the only place Biden talks about student debt. In a campaign video published on October 30, 2020, he said, "I am also going to ensure that everybody in this generation gets 10,000 dollars knocked off their student debt as we try to get out of this pandemic."

In a November 16, 2020 speech at Delaware, Biden says "it should be done immediately" on student debt forgiveness. He talks about doubling pell grants, providing free education for anyone making under $125,000 and the program to provide debt relief for those engaged in public service. A PDF published on Biden's website also talks about loan forgiveness. On page 26, you can find the same promise Biden made in the October 30 campaign video. On page 88, he also says, "for the duration of the COVID-19 national emergency, cancel monthly federal student loan payments and interest accrual, including commercially held Federal Family Education Loans (FFEL) and Perkins Loans held by institutions of higher education".

Back in March 2020, Biden also tweeted about the issue. At the time, he said, "additionally, we should forgive a minimum of $10,000/person of federal student loans, as proposed by Senator Warren and colleagues. Young people and other student debt holders bore the brunt of the last crisis. It shouldn't happen again."

Additionally, we should forgive a minimum of $10,000/person of federal student loans, as proposed by Senator Warren and colleagues. Young people and other student debt holders bore the brunt of the last crisis. It shouldn't happen again.

— Joe Biden (@JoeBiden) March 22, 2020

Biden has also made multiple promises towards other programs and plans that would help reduce student debt. As reported by Student Loan Borrower Assistance, some of the crucial points include:

1) Promise to end harsh collection tactics: "[I will e]nd the garnishment of Social Security Benefits to pay federal student loans" on page 86.

2) Promise to fix abusive servicing: "[I will e]nd federal contracts with loan servicers with a pattern of misleading or mistreating student loan borrowers” on page 86.

3) Promise to make student loans dischargeable in bankruptcy: “[I will] [e]nd the absurd rules that make it nearly impossible to discharge student loan debt in bankruptcy" listed under "Biden plan for bankruptcy reform" on his website.

4) Promises to fix income-driven repayment: "Individuals making $25,000 or less per year will not owe any payments on their undergraduate federal student loans and also won’t accrue any interest on those loans. Everyone else will pay 5% of their discretionary income" as mentioned under "Biden's plan for education beyond high school" on his website.

5) Addressing predatory schools and leaders: "The Biden Administration will require for-profits to first prove their value to the U.S. Department of Education before gaining eligibility for federal aid. President Biden will enact legislation eliminating the so-called 90/10 loophole that gives for-profit schools an incentive to enroll veterans and servicemembers in programs that aren’t delivering results.” This was also listed under the plan for education beyond high school.

6) Promise to use executive action to cancel some debt: " Cancel student loans through executive action: Public Servants or Teachers (PSLF/TLFP)[;] Borrowers who went to predatory schools: a determination of misrepresentation or fraud made by the Department, State Attorneys General or the courts will trigger automatic loan cancellation[; and,] Borrowers with a total or permanent disability.” These were listed on page 26 and 85 of the PDF.

Biden Unsure on Executive Action

Back in December, the then President-elect even acknowledged the limits of executive action. As Forbes noted, Biden told reporters "I’m going to get in trouble for saying this . . . it’s arguable that the president may have the executive power to forgive up to $50,000 in student debt... Well, I think that’s pretty questionable. I’m unsure of that. I’d be unlikely to do that.”

The reality though, is that Biden can use his power to do so. Congress granted that power to the President under the Higher Education Act of 1965, and former President Donald Trump used it three times during the pandemic. Yet, all Biden has done so far is extend the moratorium introduced by Trump and Besty DeVos. That moratorium excludes around 8 million borrowers who are part of the Federal Family Education Loan Program (FFEL).

Experts at Harvard Law School have also agreed that executive action is a legally sound way to proceed. "We conclude that your proposal calls for a lawful and permissible exercise of the Secretary’s authority under existing law," they said in a letter to Sen. Warren in 2020. Yet, the President seems unwilling to commit to executive action. In her daily briefing, Press Secretary Jen Psaki said that the President was waiting for the Justice Department (DoJ) to review the issue. "We’ll wait for that conclusion before a final decision is made,” she said.

At the Town Hall in Wisconsin, he directly addressed the issue. When asked if he would wipe out $50,000 of debt per borrower, Biden replied, "I'm prepared to write off a $10,000 debt, but not 50."

Biden has also yet to take action on a memo issued by the Trump administration, which said that the Education Department does not have the legal authority to unilaterally forgive federal student loan debt. However, the memo is not binding and can be reversed by the current administration.

What is Biden's plan now?

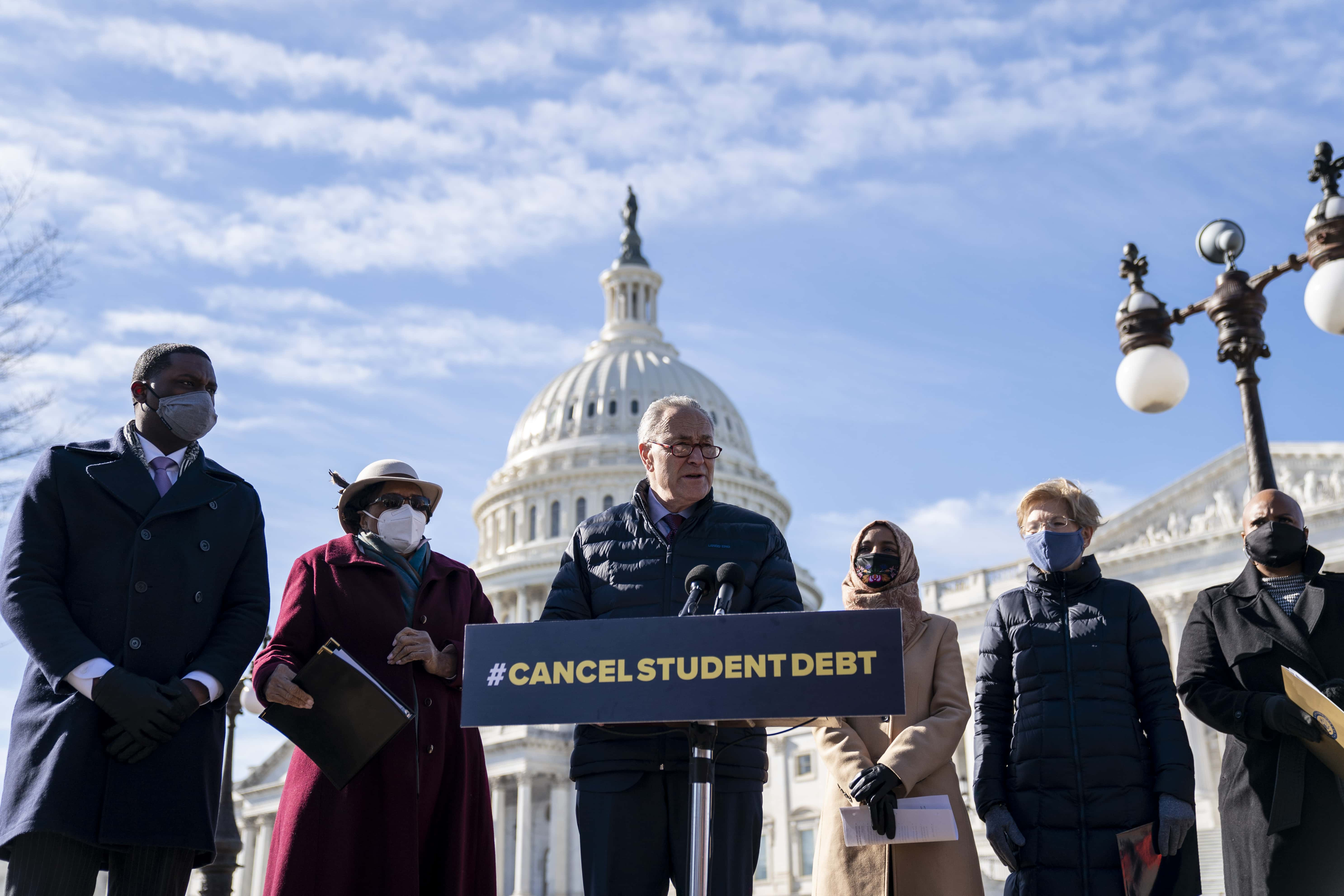

Many Democrats have called on Biden to wipe out $50,000 in debt for all borrowers, but Biden has indicated that he prefers a more targeted approach. According to Psaki, Biden believes relief above $10,000 should be targeted based on the borrower’s income and the kind of debt in question. She added, "He's calling on Congress to draft the proposal... And if it is passed and sent to his desk, he will look forward to signing it." From these statements, it can be concluded that there are two ways forward – first, executive action after a review by the DoJ, and second, bills passed through Congress.

The latter seems least likely to happen, with Republicans strongly opposed to blanket debt relief that the Democrats want. While they might get behind targeted relief, it is unlikely that any Democrats will support such a limited measure. That leaves Congress in what can only be described as a "Mexican standoff" – a confrontation in which no strategy exists that allows any party to achieve victory.

People who are unable to pay their loans are disproportionately from minority communities with blue-collar or service jobs. As Senator Schumer said, "After 20 years, only five percent of Whites have student debt, but 95 percent of African Americans have debt."

How beneficial is the Democrats' plan to wipe $50,000 of loan for everyone?

CNBC estimated that it would "shrink the country’s outstanding student loan debt balance to $700 billion from $1.7 trillion." Around 36 million people would benefit from the plan, with the greatest benefits going to women and people of color.

Is Biden shirking from his responsibility to help millions of Americans get back on their feet? Will he wait for the DoJ review, which could take months? Is it unlikely to see any action taken on the matter, even if Democrats desperately push for it? Time will tell.