Who owns Zelle? A look at the payment service's net worth as it beats PayPal's Venmo's transaction value

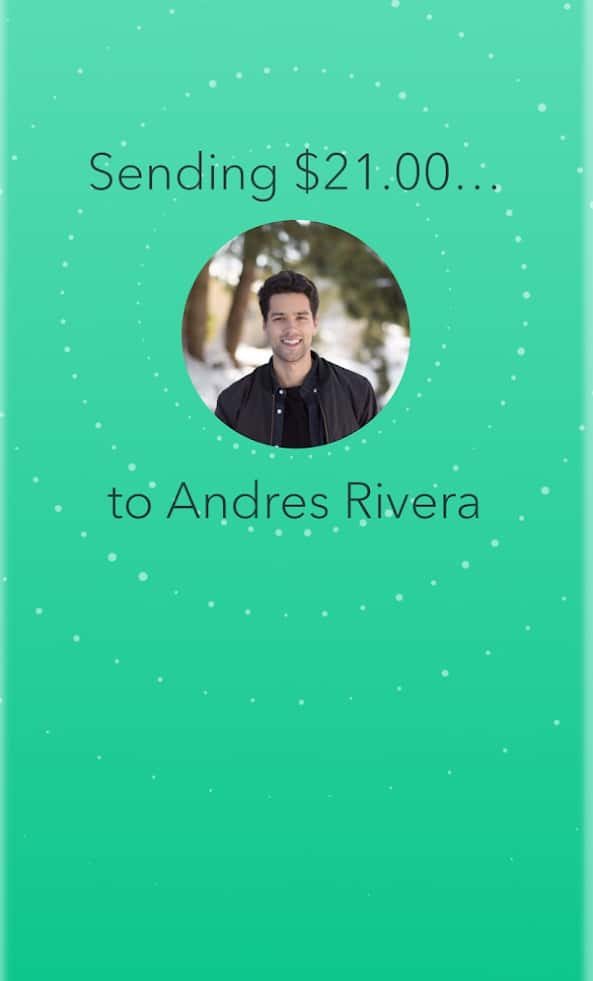

Zelle, the hottest new kid on the block is a peer to peer (P2P) payment service that is attracting thousands of new users. In fact, it has become so popular it has taken over Cashapp and Venmo, who were once considered leaders in the P2P payments industry. Today, Zelle is not just another payment gateway, but 'the' payment method for many.

The app is currently trending online with users calling it everything from a lifesaver to a 'superior cash transfer app'. It's no surprise how Zelle got here. The app is backed by some of the biggest banks in the US and supports nearly 7,000 financial institutions. But how did the app get so big? That has to do with its history and origins with America's biggest banks.

READ MORE

Who owns Zelle?

Zelle was founded as ClearXchange in 2011. The service offered P2P and business to business (B2B) payments. In 2016, it was sold to Early Warning Services (EWS), a company run by Paul Finch. EWS is owned by Bank of America, BB&T, Capital One, JPMorgan Chase, PNC Bank, US Bank, and Wells Fargo. The company rebranded and relaunched the service as Zelle in 2017. Since it is owned by the banks, Zelle can do several things other services can't.

For one, Zelle can send money directly to a bank account. Other services often use a 'wallet' or other intermediary systems. The additional step often requires customers to then transfer money to their accounts. Another advantage of Zelle is that it is nearly instant. You can send and receive money to your account in minutes, which other services like PayPal's Venmo and Square Cash charge for. Zelle also doesn't charge any fees for the service, any fees are levied by the bank, but most banks choose not to.Nearly 7,000 financial institutions rely on the Zelle mobile app and over 457 new financial institutions of all sizes joined the Zelle Network® in 2020.

Finally, Zelle itself does not limit the amount of cash you can send through the app. Limits are based on your bank, giving users the freedom to use the service for larger transactions. The average transaction size was $273 on the app. Those factors allowed Zelle to clear $307 billion in 2020, as compared to the $160 billion Venmo cleared the same year. According to a press release, Zelle saw payment values increased by 62% while transaction volumes increased by 58%.

Zelle is compatible with nearly all major banks and most even have the service integrated into their mobile banking app. Consumers who download Zelle's standalone app need to give a phone number or email and debit card information to use the app. A Visa or Mastercard debit card user can download Zelle and use the application to send money.

The pitfalls of Zelle

Zelle isn't a complete magic wand though. The service does have several downsides. It cannot be used for in-store payments like Apple Pay, or for international payments like PayPal. That's not all though, the lack of fraud protection could make the app a prime target for scammers. A TechCrunch investigation found that Zelle scams are all the rage, since the app doesn't have the same protections PayPal or other services do. Since it is so simple to use and is backed by the banks, many people have taken to pay scammers for items of services like Craigslist that never arrive.

Zelle responds to complaints of fraud with the standard line that that app is only meant to be used with "people you know". As TechCrunch put it, "What consumers don’t realize is that Zelle is actually more like Venmo than PayPal – meaning it’s only meant to be used for peer-to-peer digital payments with people you trust, like friends and family. Just like Venmo, Zelle does not offer fraud protection for buyers or sellers on its transactions."

It's not the first time Zelle has gotten into trouble. Back in 2018, the New York Times reported on the same issue. Hidden on Zelle's support page, the company says "Zelle does not offer a protection program for any authorized payments made with Zelle - for example, if you make a purchase using Zelle, but you do not receive the item or the item is not as described or as you expected." It specifically covers the cases of fraud both publications found, but since it's hidden away customers usually aren't aware till it is too late.

Despite those woes, Zelle still remains a popular option for many. The simple interface, deep intergration with banks and wide support with many financial institutions have allowed the company to claim 11.3 million active users. That's just a fraction of the 52 million monthly active users Venmo has.