Democrats no longer the party of middle-class and poor? 74% GOP taxpayers have income less than $100K: IRS data

In 2018, a study showed that Democrat officials were much likelier to share the policy opinions of the poor or middle class on economic policy, while Republican officials were likelier to diverge from middle-class public opinion in favor of representing the views of the wealthy.

While this may still hold, the voter base of both parties has flipped to a certain degree.

READ MORE

Are Democrats no longer the party of the middle-class and the poor?

Democrats represented 65 percent of taxpayers with a household income of $500,000 or more in 2020, according to IRS data, while 74 percent of taxpayers in Republican districts have household incomes of less than $100,000. This is a significant departure from what used to be.

As per a report, in 1993, the dynamic was different, with the typical Republican congressional district showing it was 14 percent wealthier than its Democratic counterpart. In 2020, data shows those Republican districts were now 13 percent poorer.

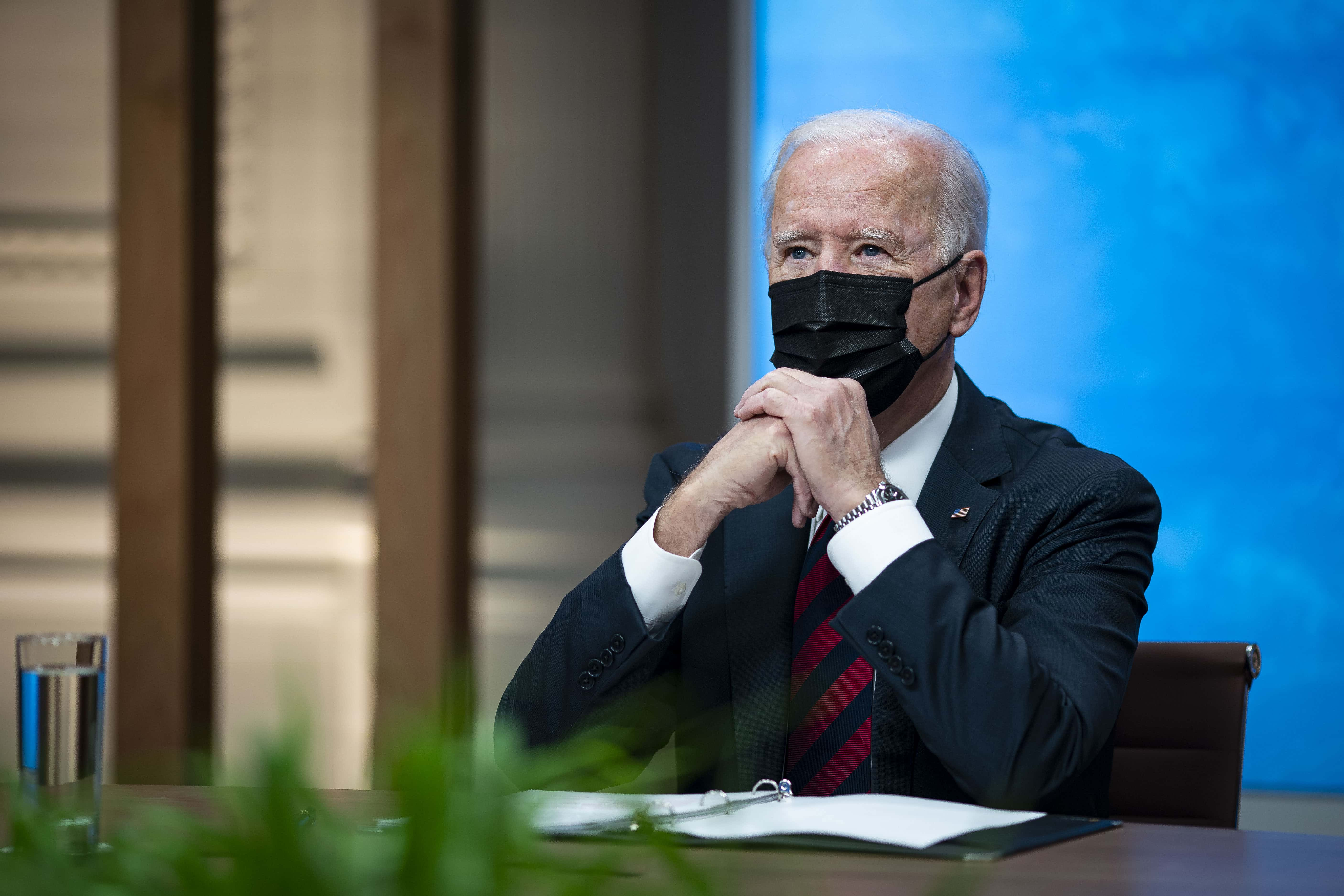

As per a Bloomberg report, this change is interesting in the wake of President Joe Biden asking Congressional Democrats to vote for a tax increase. Former President Donald Trump’s 2017 tax law capped the federal tax deduction for state and local taxes at $10,000. The beneficiaries would predominantly be the one percent of the US’s wealthiest households, where property owners in high-tax states will benefit from the relief on federal taxes.

“Many of my constituents would be willing to pay the bill if what they’re paying for is visible, tangible, and useful to them,” said Tom Malinowski, a Democrat who represents a wealthy New Jersey district. “I think President Biden gets it. He’s selling this plan primarily as a way to rebuild America. That all makes sense to the people I represent. That’s an investment with a high return.”

But even though fewer Republican voters would pay the tax increases directly, Republican members of Congress are more dependent than Democrats, though, on PACs that represent corporate interests. In 2016, House Republicans reportedly received about twice the donations that Democrats did from corporate political action committees. In 2020, business-interest PACs gave $181 million to Republicans and $135 million to Democrats.

Despite the fact that Biden’s tax reforms are set not to affect the middle class (by much), many believe that it is a misguided approach — even if it does help the party look less “socialist” than what the GOP usually claims. In a Washington Post column, Eric Harris Bernstein of UC Berkeley’s Goldman School of Public Policy and Ben Spielberg, co-founder of 34justice.com, argued for increased middle-class taxation.

“Middle-class taxes are a necessary and desirable part of a comprehensive, progressive policy framework that benefits low- and middle-income people most,” the column said. “When redistributed through universal programs like Medicare-for-all (or free child care, free college, paid family leave, etc.), broad taxes provide stable funding and a sizable return on investment. Democratic presidential candidates should make the case for middle-class taxes, not run from them.”

Writing off middle-class tax increases is a mistake, they argued. “For one thing, raising revenue is not the sole purpose of taxing the extremely wealthy — another goal is to make them not so extremely wealthy anymore. Relying primarily on taxes on accumulated wealth and top incomes to fund government spending would mean that, if these policies succeed in reducing inequality, they would also shrink revenue and constrain public investment over time.”