Who was Alexander Kearns? Parents sue Robinhood as son, 20, kills himself believing he owed trading app $730K

A 20-year-old college student allegedly committed suicide in June 12, 2020, after seeing a negative cash balance of $730,000 in his account on the Robinhood stock trading app. His parents are now suing the company for wrongful death, negligent infliction of emotional distress and unfair business practices. Alexander Kearns reportedly threw himself in front of an oncoming freight train in Naperville, Illinois.

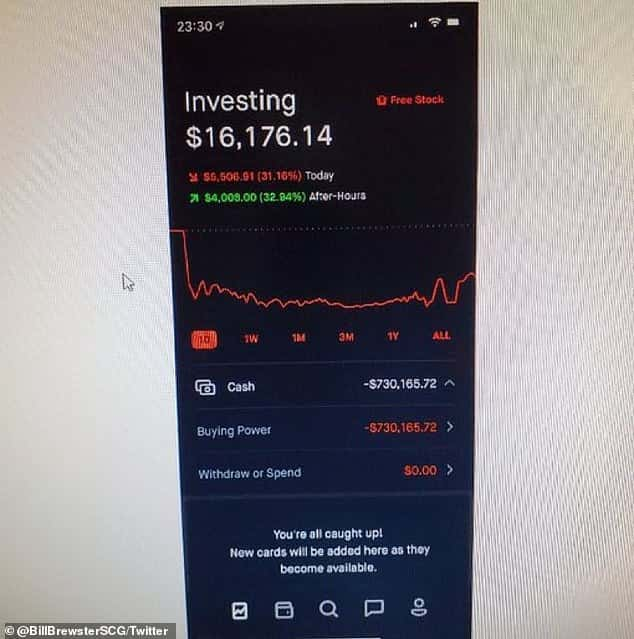

The University of Nebraska student, who started dabbling in trading, believed that he suffered a huge loss when the app put a hold on his trading account on June 11, 2020. The app showed what appeared to be a negative balance of $730,000 and said that he needed to pay $170,000 in the coming days. In Kearns’ case, his account showed a balance of $16,000.

READ MORE

In an interview with CBS This Morning, Dan and Dorothy Kearns said they believe Robinhood pushes young and inexperienced customers, like their son, to engage in risky trading. In the lawsuit, obtained by CBS, the Kearns said Robinhood provided no "meaningful customer support" when their son reached out for help with the matter. In the lawsuit, Dan and Dorothy say Robinhood "must be held accountable".

Responding to the allegations, a Robinhood spokesperson said: "We disagree with the allegations in the complaint by the Massachusetts Securities Division and intend to defend the company vigorously."

The couple said that their son came home early last year due to the Covid-19 pandemic. His mother, Dorothy, said that her son was interested in investing and before he graduated from high school, he opened an account with Robinhood. According to his parents, Alex started investing the money he earned from working as a lifeguard and funds given to him by his grandparents. In addition to the lawsuit, Alex's parents also revealed that when he saw the negative balance of $730,000, he reached out to Robinhood, telling them it had to be a mistake. But after that his account got restricted on June 11 and later that night, the company mailed him demanding Alex to take "immediate action" and pay them $170,000.

Alex's parents believed he had "limited exposure" but they didn't realize that Robinhood had approved Alex to buy and sell options, which has the potential for huge losses. "I don't understand how they allowed that to happen in the first place," Dan, Alex's father, told the network. "I lost the love of my life. I miss him more than anything," Dorothy told CBS. "I can't tell you how incredibly painful it is. It's the kind of pain that I don't think should be humanly possible for a parent to overcome."

"He thought he blew up his life. He thought he screwed up beyond repair," Dan told CBS. Robinhood had no customer service phone number, but Alex emailed its support address three times on June 11 and the next day. According to his parents, Alex had asked for help understanding what happened and wanted to figure out if he could still offset the losses with another trade. "I was incorrectly assigned more money than I should have, my bought puts should have covered the puts I sold. Could someone please look into this?" Alex wrote in one email.

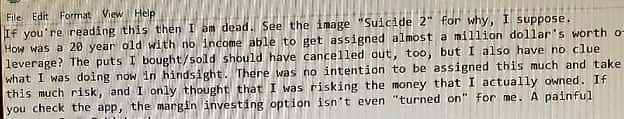

Alex left a heartbreaking suicide note, part of which was published online by his cousin-in-law Bill Brewster. In his suicide note he wrote, “How was a 20 year old with no income able to get assigned almost a million dollar’s worth of leverage?” Kearns allegedly wrote. “The puts I bought/sold should have canceled out, too, but I also have no clue what I was doing now in hindsight. There was no intention to be assigned this much and take this much risk, and I only thought that I was risking the money that I actually owned. If you check the app, the margin investing option isn’t even ‘turned on’ for me. A painful lesson. Fuck Robinhood.” From his note, Alex appeared to have been using what's known as a 'bull put spread', a strategy that limits risk for a trader by both buying and selling put options at different strike prices.

Alex received an automated e-mail from Robinhood that reads: "Thanks for reaching out to our support team! We wanted to let you know that we're working to get back to you as soon as possible, but that our response time to you may be delayed."

On June 12, 2020, Alex took his own life. The day after he died, Robinhood sent an automated email stating that he didn't owe any money. "Great news! We're reaching out to confirm that you've met your margin call and we've lifted your trade restrictions. If you have any questions about your margin call, please feel free to reach out. We're happy to help!" the email reads.

At the time of Alex's death Robinhood co-founders Vlad Tenev and Baiju Bhatt released a statement and said that they were “personally devastated by this tragedy", and pledged to “improve Robinhood’s customer experience". The company is looking at making adjustments to its platform around option flows involving multi-leg exercise and assignment. They now have a call back option from a live agent and are adding screening for experience in case of riskier trades. The company donated $250,000 to the American Foundation for Suicide Prevention after Alex's devastating death.