Sam Bankman-Fried faces 115 years in prison: Here are the worst 8 financial fraudsters ever

MANHATTAN, NEW YORK CITY: Sam Bankman-Fried, the infamous founder of crypto exchange FTX, has been found guilty of stealing nearly $10 billion of his client’s money, in what the prosecutor described as "one of the biggest financial frauds in American history."

On Thursday, November 2, a 12-member jury in Manhattan federal court took over four hours of deliberation to reach the verdict, convicting the crypto crook of all seven charges of fraud and conspiracy, according to Daily Mail.

The charges against Bankman-Fried include counts of wire fraud and conspiracy to commit wire fraud against FTX customers and against Alameda Research lenders, conspiracy to commit securities fraud and conspiracy to commit commodities fraud against FTX investors, and conspiracy to commit money laundering.

Bankman-Fried perpetrated 'one of the biggest financial frauds' in US history

The 31-year-old Bankman-Fried now faces up to 115 years in prison. The verdict was rendered a little under a year after FTX abruptly filed for bankruptcy, shocking the financial world and wiping off his estimated $26 billion personal wealth.

Following the recitation of the convictions, Southern District of New York US Attorney Damian Williams stated in a briefing that "Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history."

Who are America's 'worst financial fraudsters'?

Bankman-Fried’s conviction has now brought attention to some of others on the list of 'worst financial fraudsters in American history'.

Elizabeth Holmes

Once described as "the world's youngest self-made female billionaire," Elizabeth Holmes, who founded her company Theranos at the age of 19 is currently serving jail time after being convicted of defrauding investors about her company’s core technology and business dealings.

In January 2022, Holmes, who raised $945 million for Theranos and promised that the start-up would revolutionize health care with tests that required just a few drops of blood, was found guilty on four counts of defrauding investors – three counts of wire fraud and one of conspiracy to commit wire fraud.

Nearly ten months later, Holmes was sentenced to 11 years in prison. New federal documents, however, indicate that her 11-year sentence has already been shortened by two years.

She is currently serving her time at a prison camp in Bryan, Texas, according to Business Insider.

Ivan Boesky

Ivan Boesky was reputed as one of the wealthiest stock market speculators in the United States before he served jail time on insider trading charges.

Boesky, well known by his nickname 'Ivan the Terrible', amassed almost $200 million via investments in mergers and business takeovers.

In 1985, the Securities and Exchange Commission (SEC) accused Boesky of acquiring stocks and futures in companies based on tips from company insiders and filed charges against him for unlawfully benefiting from insider trading.

A year later, Boesky was found guilty and received a three-and-a-half-year jail term based on a plea agreement that involved Boesky taping phone calls with other insider trading conspirators, including junk bond king Michael Milken of Drexel Burnham Lambert, according to US News.

"I think 'immoral' is the wrong word for [my] acts. I prefer the word 'unethical'"

— MacCocktail (Mastodon: @MacCocktail@zirk.us) (@MacCocktail) March 6, 2019

―Ivan Boesky (born March 6, 1937) pic.twitter.com/pzX0sqFv5C

Following his release from jail, Boesky enrolled in rabbinical studies and was active in initiatives that assisted the homeless. Since then, he has stayed out of the spotlight, living quietly in La Jolla, California, according to Investopedia.

Bernie Madoff

Former New York City fund manager Bernie Madoff is infamous for running the worst financial Ponzi scam in American history.

It has been reported that Madoff allegedly defrauded investors of $19 billion over the course of two decades until the scheme was discovered in 2008.

In the late 1980s, Madoff gained notoriety as one of the pioneers of computerized trading. He went on to become the chairman of the Nasdaq from 1990 to 1993.

Following that, he started his own investing business, which attracted billions from both large and well-off individuals and tens of thousands of smaller, indirect investors through several feeder funds.

Regulators and auditors, however, became suspicious after Madoff's fund consistently returned high returns, even when markets tumbled. When the financial crisis hit in 2008 and the markets began to decline, Madoff was forced to admit to his Ponzi scheme.

He was then arrested and charged with 11 counts of fraud. Madoff passed away in jail in 2021 at the age of 82 after receiving a 150-year sentence in 2009.

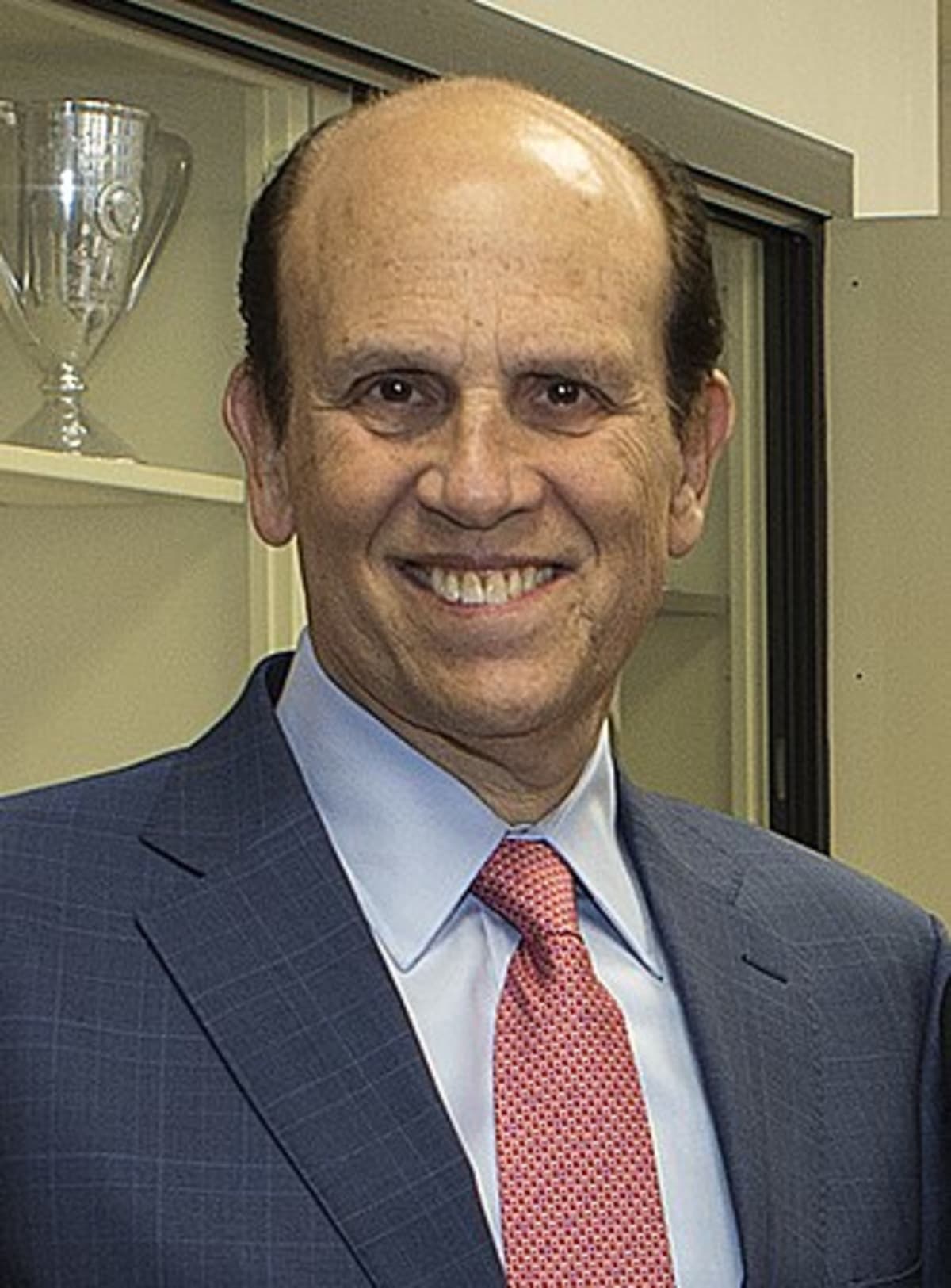

Michael Milken

A superstar on Wall Street in the 1980s, Milken was an innovator who created the ''junk bond'' market that financed many big corporate takeovers in the 1980s.

In March 1989, Milken was indicted on 98 counts of racketeering and fraud. At that time, he was charged with a long list of wrongdoings in the indictment, which included many instances of repaying illegal gains, tax evasion, insider trading, and stock parking (which is the practice of hiding the true owner of a stock).

Pleading guilty in 1990 to six felony counts of securities fraud and conspiracy, he was sentenced to 10 years at a federal minimum-security prison and was barred for life by the SEC from working in the securities field.

He served nearly two years, before being released with a diagnosis of prostate cancer. Following his release, Milken rebranded himself as a pioneer in business education and a cancer activist.

His website describes him as a medical research innovator, philanthropist, and financier. In February 2018, then-President Donald Trump even granted him a full pardon.

Bernard Ebbers

Ebbers made a name for himself after serving as CEO of WorldCom, the second-biggest long-distance telecom corporation in the US in early 2000.

Ebbers possessed shares of WorldCom worth hundreds of millions of dollars, which he borrowed against to invest in other business ventures.

However, the telecom corporation collapsed and went into bankruptcy in 2002, following revelations of an $11 billion accounting fraud. Subsequently, it was revealed that top executives had exerted pressure on their subordinates to inflate numbers to make the company seem more profitable.

In 2005, Ebbers was found guilty of securities fraud and other offenses, and he was sentenced to 25 years in prison.

A federal judge granted his parole on the grounds of his health after he had completed 13 years of his sentence. However, he died shortly thereafter in February 2020.

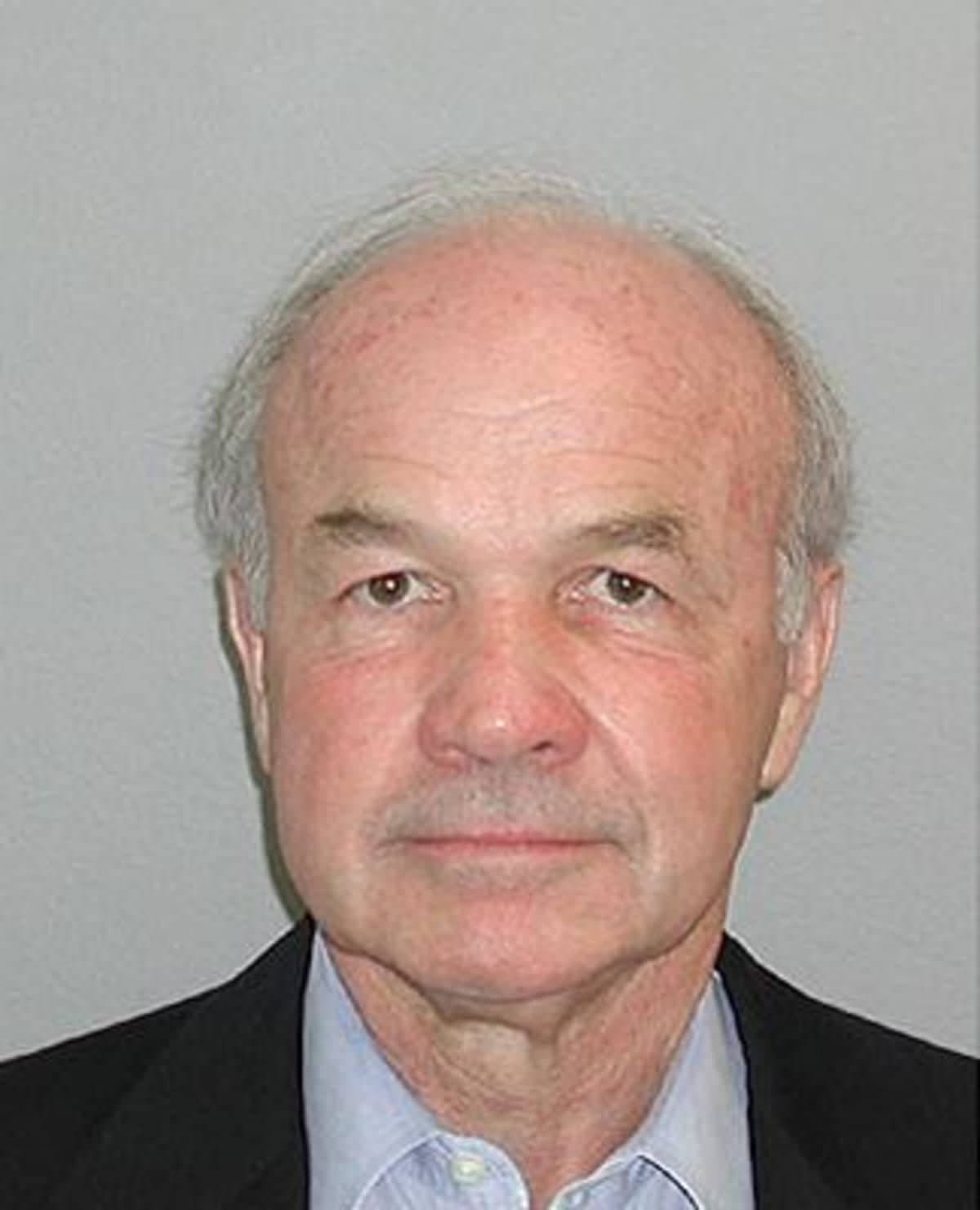

Kenneth Lay

Kenneth Lay was the founder, chief executive officer, and chairman of Enron, which was dubbed "America's Most Innovative Company" by Fortune magazine every year from 1996 to 2001.

Enron's stock peaked in August 2000 at $90, but a year later, finance executive Sherron Watkins alerted Lay to the impending catastrophe of a big accounting fraud that would bring down the entire business.

Amid SEC inquiries into its finances, in November 2001 Enron admitted it overstated profits by nearly $600 million. Within roughly two months, the company declared bankruptcy which shook financial markets across the world.

After the Justice Department launched a criminal investigation of Enron, the jury determined that Lay and his partner Jeffrey K Skilling had misled regulators, workers, and investors in order to hide the financial vulnerabilities of their energy business.

For his part, Lay was indicted by a grand jury on 11 counts of securities fraud, wire fraud, and making false and misleading statements.

While awaiting his sentencing, Lay died of a heart attack on July 5, 2006.

Tom Petters

In 2010, Thomas Joseph Petters, of Wayzata, Minnesota, had been sentenced to 50 years in federal prison for orchestrating a $3.7 billion Ponzi scheme.

He was accused of stealing money from hedge funds, missionaries, and pastors alike, according to the New York Times.

Petters assured investors that by investing heavily in his company, they would finance the acquisition of retail goods, which would then be profitably sold to discount stores.

But that’s not what happened, and in 2008, he was indicted in 2008 on multiple counts of mail fraud, wire fraud, money laundering, and conspiracy for operating a scheme that spanned 26 countries, including the Cayman Islands, Germany, and Switzerland.

He is currently an inmate at the federal prison in Leavenworth, Kansas, according to Kare11.

Stephen Condon Peter

In 2021, Stephen Condon Peters, a former Raleigh investment advisor and owner of Visionquest Wealth Management, was sentenced to 40 years in prison for securities fraud, including investment advisor fraud, fraud in the sale of unregistered securities, and related charges.

He allegedly defrauded clients by steering them to investments in which he had a personal financial interest, stole clients’ funds, and made misstatements to the SEC.

In addition to his prison sentence, the court ordered Peters to pay restitution of more than $15 million.